Most people, when asked, are able to quickly list the stressors they face heading into the holidays. Some wear this list like a badge of honour and are motivated by it. Others collapse under its weight. Consider for a moment the stressor at the top of your holiday list: Is it the pace, or the financial stretch that accompanies the season? The loneliness, or the impending arrival of a difficult visitor that triggers anxiety? Changes in diet, exercise routine and sleep habits can also throw you off your game. So can the eggnog.

What if there were an instant solution to your stress? What if this solution magically arrived at your doorstep tomorrow morning, instantly eliminating No. 1 on your stress list? How would that change things for you?,” wrote Dr. Dwight Chapin, Health Advisor, for The Globe and Mail on December 4, 2015.

Chapin continued, “An estimated 80 to 90 per cent of all disease is strongly influenced by stress.

70 to 90 per cent of family doctor visits are due to stress-related issues.

To give you a better sense of the power stress has over the body, it drives somewhere in the neighbourhood of 1,500 biochemical reactions within fractions of seconds of you facing the stress. Neurotransmitters are activated, hormones are released and nutrients are metabolized. You likely know this as the “fight or flight” stress response.”

Read the full article here.

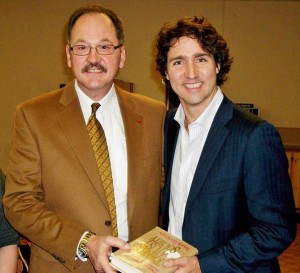

Raymond Matt, CFP, CLU, TEP, CHS